Every shipper, producer, or trader wants logistics service providers who offer services that seamlessly fit their own operations and customer expectations for service, while not paying more than necessary. After all, freight directly affects customer satisfaction and your profit margin, and therefore the continuity of your business. Optimizing this begins with purchasing freight services through freight tendering.

Purchasing freight services is a complex and time-consuming process. Each mode of transportation has its own challenges. Because purchasing freight services is not a daily process, many companies gain relatively little process and market knowledge. Additionally, often there is no freight tender software available to gain a good understanding. However, these elements are crucial for effective purchasing of freight services.

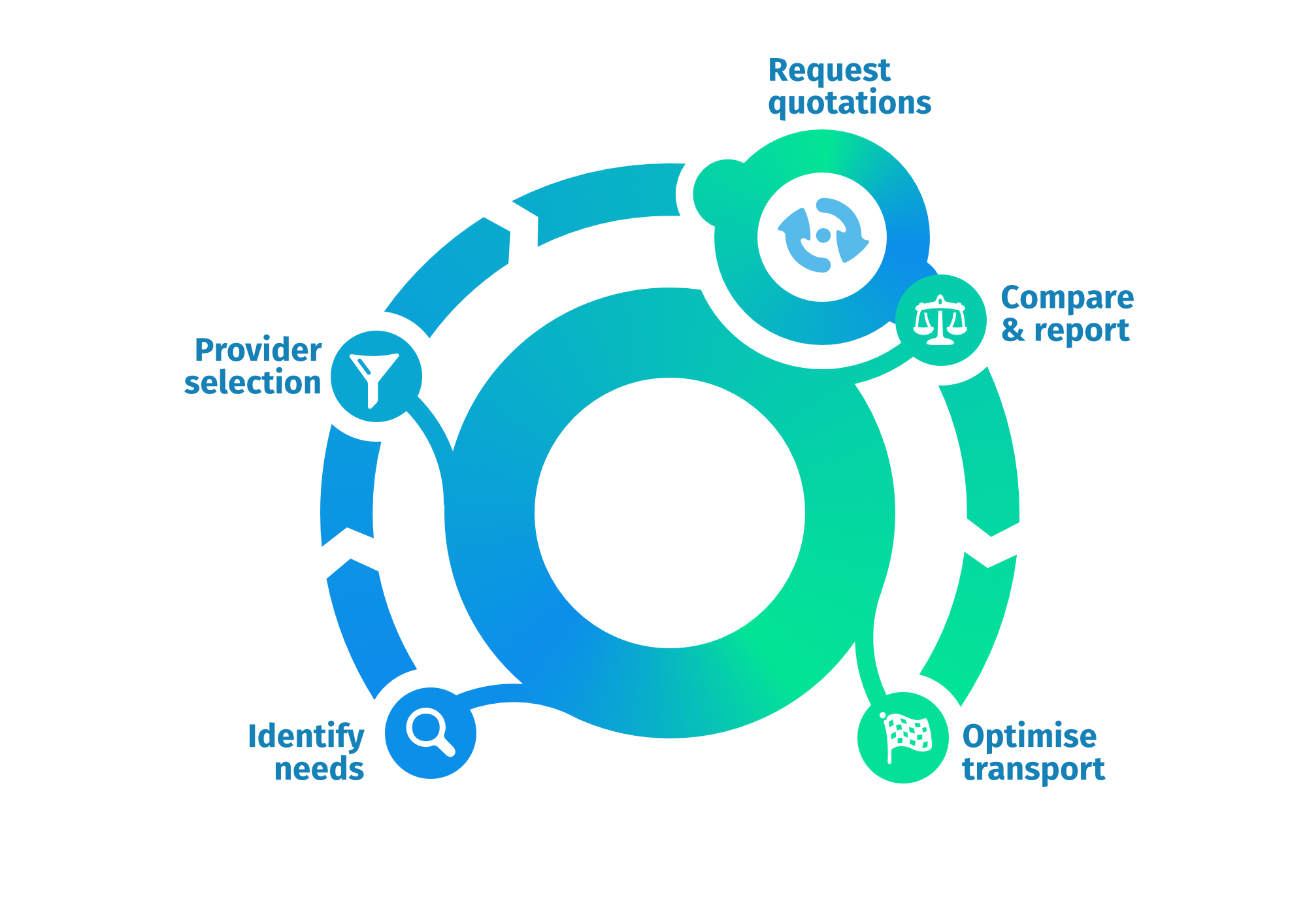

Freight is essential for customer satisfaction, must seamlessly integrate with business operations, and freight costs directly impact margins. Our procurement process is aimed at optimizing quality, service, and costs. First, we determine together what is really necessary. Good data, for example, from your own TMS, helps with this.

In addition, we use input from logistics, sales, production, warehouse, finance, and customer service. Then, we help select freight carriers. Of course, we consider current partners, but also parties of which we know the network and offer service that is a perfect match. We are completely independent in this and therefore have no (commission) agreements with freight carriers and select the best potential partners for you!

A good selection ensures a high response rate and competitively priced quotes. With our procurement software, we analyse the quotes and present decision-making information. Our software also provides detailed feedback to participating freight carriers to help optimise their quotations. Finally, we advise on which mix of carriers leads to good coverage of your shipment profile with sufficient flexibility and robustness. Where necessary, we help with drafting SLAs and contracts.

Through the many tenders we annually do and information from our TMS, we gain insight in carriers and rates. From a completely independent position, we can connect our customers with the best carriers for their profile.

With a good process process you realise transparent and homogeneous offers, allowing an accurate comparison on both costs and all important qualitative aspects. It also ensures a fixed and fast turnaround time.

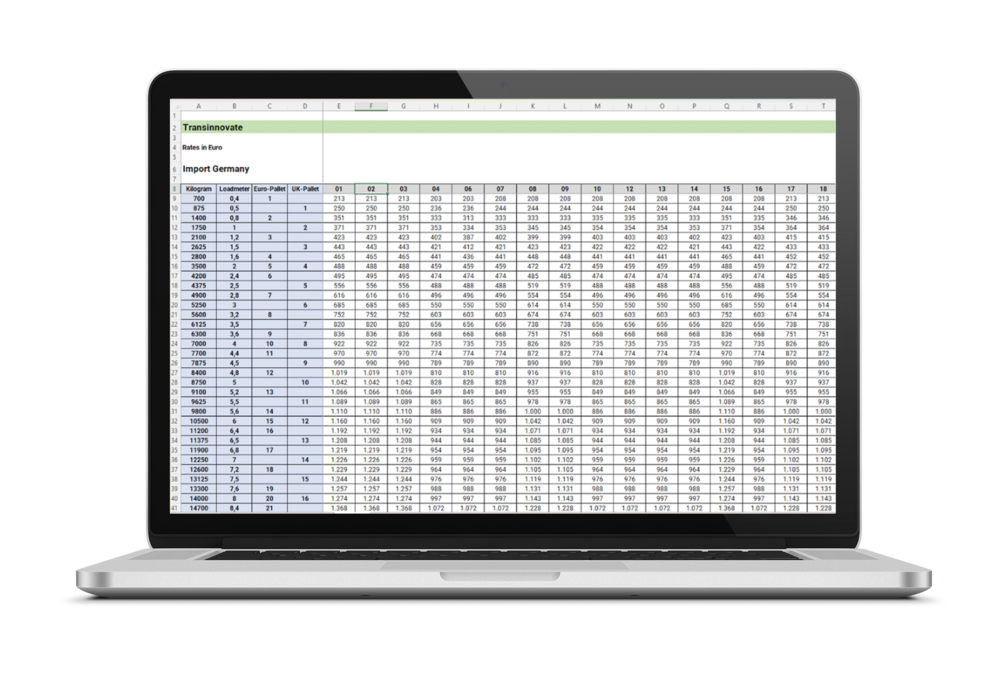

Good tools are half the work, and this also applies to purchasing of freight. The way freight rates are offered, with various scales and surcharges, requires specialized software.

Every company is different and a procurement process must therefore be tailored. We provide customization in our service, from complete outsourcing to just support in the analysing the freight rates.

There are many providers that offer purchasing software. The excessive reliance software can lead to the neglect of essential communication with carriers. For us, the focus is not on the tools we utilize, but rather on maintaining meaningful connections with our customers and carriers.

The costs for a tender depend on quite some variables, such as the number of carriers and tariff tables that need to be processed. If possible and desired, we work against no cure no pay.

Looking to gain more knowledge in optimizing or managing transportation? In our transport guide, we provide you with:

We will respond within one business day

We distinguish ourselves with market knowledge and experience combined with our software tools

Our approach is concrete and pragmatic

We distinguish ourselves with knowledge and experience in combination with our software tools. Our approach is above all concrete and pragmatic. We would be happy to discuss your challenges with you and explain without obligation how we can support you with our data-driven analyzes and/or software applications.

To assist you promptly, we have compiled a list of frequently asked questions. Here, you’ll find concise answers to the most common queries. If you need further information, please feel free to contact us.

Typically, one should consider a minimum lead time of 3 months, involving two tender rounds. A well-executed tender requires carriers to invest sufficient time to understand the case and provide rates. Adequate time is also needed to gather the right shipment data, create tender and feedback documentation, and conduct scenario analyses. Large projects may take even longer.

Costs depend on two aspects: the expected service and the scope. Do we handle the entire tender or only a specific part, also the number of locations/countries and carriers involved play a crucial role. Generally, we see our clients achieve savings between 10-30%, with peaks up to 40%, and our record is almost 50%. We can work on a performance basis, with no or reduced fixed costs, if desired.

Data is crucial for organizing a Transport Tender. The better your transport data, the more targeted and competitive the offers from carriers. We always recommend sharing a year’s worth of detailed information during a tender. This includes origin-destination pairs, dimensions, weights, and any specific information such as desired surcharges. Better-matching profiles result in more competitive rates. Insufficient data may lead to cautious offers with built-in buffers.

This depends on the industry in which our client operates. Generally, we advise our clients at Transinnovate to consider long-term partnerships. To achieve successful collaboration with continuous improvement, a recommended partnership period is usually 3 to 5 years. After this period, it is advisable to evaluate market changes and whether tariff rates are still competitive.

This strongly depends on the industry in which a company operates, the shipment profile, and the ultimate scope. For example, if only 1-pallet shipments are sent within the Netherlands, it makes sense to invite specialized logistics providers, limiting the number. However, if shipments are sent from multiple countries to various countries in Europe, involving both small (Groupage) and full truckloads (FTL), the number of required carriers can increase to 50 or even 100. Transinnovate can assess the shipment profile and desired service, then involve the best-matching carriers from the market for your transport tender based on both cost and quality.

In short, it’s market knowledge, process expertise, and unique software. Many companies do not procure transport systematically, leading to a lack of market knowledge and experience in the do’s and don’ts of transport tenders. Additionally, there is often a lack of software for complex scenario analyses. A transport tender is time-consuming, and we can provide the extra support needed to relieve the organization.

We provide detailed decision-making information for our clients. Our software precisely calculates the cost of choices made down to the euro. We use the software to analyse a representative shipment profile (usually annual shipments) against received quotes. This provides a clear cost breakdown for each shipment with every carrier. We then collaborate with our client to analyse scenarios based on available capacity, sustainability, service levels, and the use of one or more carriers per region, country, or overall package. The outcome is an analysis supporting well-founded decisions.

Feedback is crucial for carriers to understand how to strengthen their offers. This leads to improved offers in subsequent tender rounds. We often provide, in consultation with our client, a detailed report at the shipment level. This allows the carrier to see the strengths and weaknesses of their offer. While there are winners and losers in a transport tender, providing proper feedback ensures rejected carriers understand the reasons, keeping future opportunities open. This is beneficial, as you may need them in time.

Yes, this is possible. We can assist in writing tender documentation until support the decision-making process. During the project, we even handle all communication with the carriers. Ultimately, our clients themselves finalize contracts or agreements with the awarded carriers. We also offer support on specific aspects of a tender, such as creating complex scenario analyses using our software. Our service is fully tailored to the needs of our clients.

There are many pitfalls, but likely the two biggest are entrusting communication with a carrier to tender software and adhering to a fixed template for quotes. These often go hand in hand and can lead to significantly increased freight costs. Tendering is personal; carriers want to know who, what, and why they should participate, as tenders consume a lot of their time. Often, carriers that are forced to use tender software only receive a notification that they can participate. This may cause the best companies for your profile to opt-out—a missed opportunity. It’s crucial to use a personal approach and software that allows carriers to use their own format. Please review our blog (link https://transinnovate.com/en/pitfalls-procurement-of-transport-the-killing-rate-template/) for more insight.

It starts with a detailed description of the desired service in the RFQ (Request for Quotation) document. Consider aspects such as trailer types, company types, operating hours, lead times, service levels, etc. Subsequently, a compliance document can be drafted, asking carriers to indicate how they handle these aspects and whether they can meet them. The questions in the compliance document can be ranked, generating a score for each carrier. Kick-out criteria can also be added, stating that if carrier cannot meet certain aspects, collaboration will never materialise. Finally, compliance scores can be compared with scenario (cost) analyses, allowing decisions to be made based on both cost and service during the decision-making process.