We receive frequent questions about which INCOTERMS in 2026 should be used, whether there are any changes compared to the Incoterms in 2025, and what considerations to keep in mind when purchasing transport. Let’s start with making clear that Incoterms 2025 or Incoterms 2026 do not exist.

ICC Incoterms® are standardized international delivery terms agreed upon between buyer and seller. These are rules that establish worldwide agreements on transport, costs, and any potential damage during transportation. Every ten years, the International Chamber of Commerce (ICC) updates the Incoterms®.

The most recent version, the ICC Incoterms® 2020, came into effect on January 1st, 2020. Companies may use earlier versions of the Incoterms® as long as it is clear which version is being referenced. This means that the most recent Incoterms version in 2026 is the Incoterms® 2020 version. However, it is also allowed that the Incoterms version in use by a company in 2026 is the Incoterms® 2010 version.

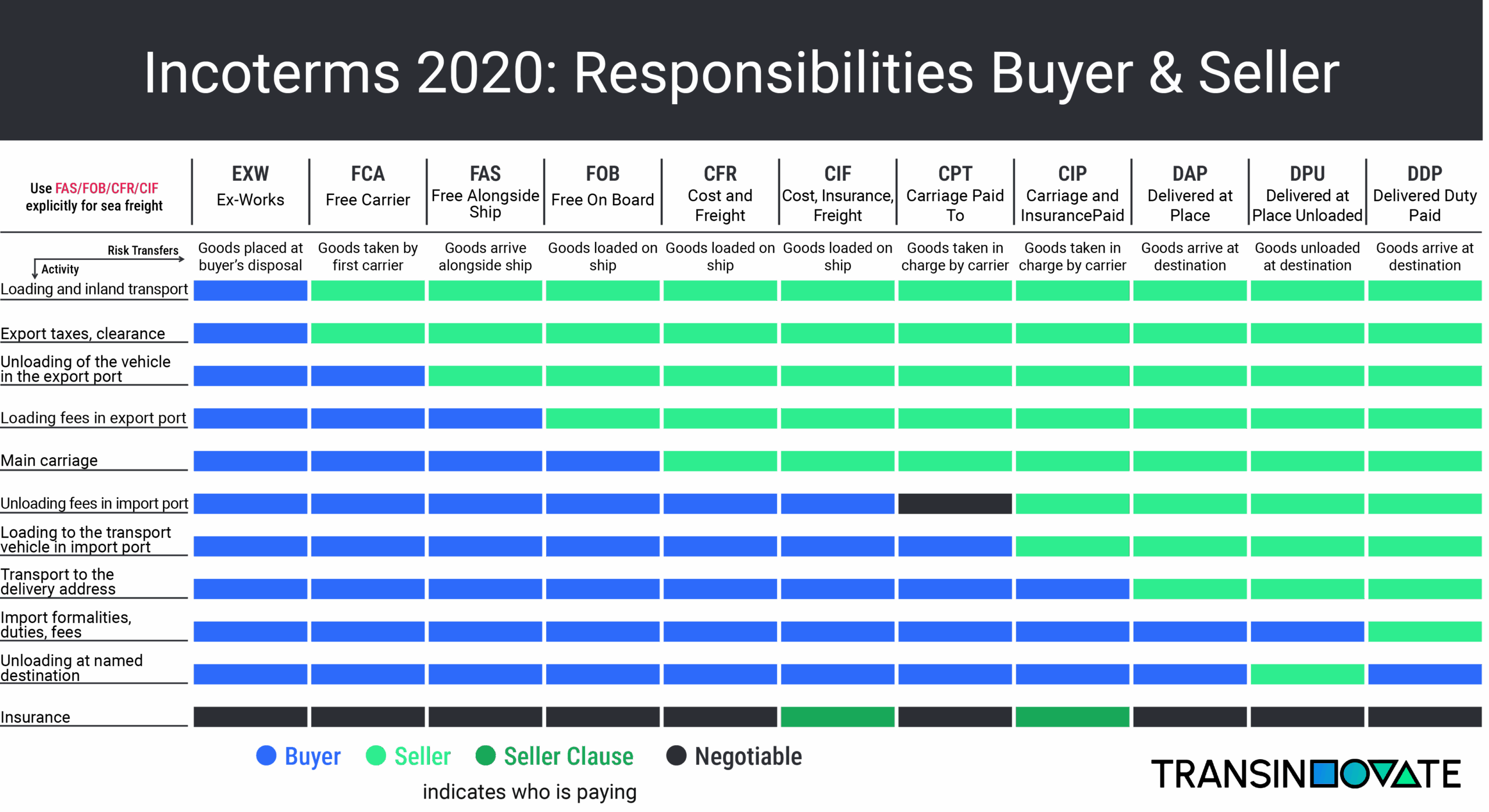

The ICC Incoterms® regulate the following:

- Who arranges transport and to where, who arranges transport insurance, and who is responsible for any import and export licenses.

- Who pays for transport costs and additional costs, such as loading and unloading, customs clearance, and packaging.

- When the risk of loss or damage to the goods passes from the seller to the buyer.

ICC Incoterms® 2020 has 11 delivery terms (Incoterms® rules).

Four of these are specifically designed for water transport. The other seven apply to all types of transport (multimodal transport). Which ICC Incoterms® are used depends on the type of transport and the agreements between the buyer and seller.

Below is a visual representation of the differences between each Incoterm®. Additionally, each Incoterm® rule is described.

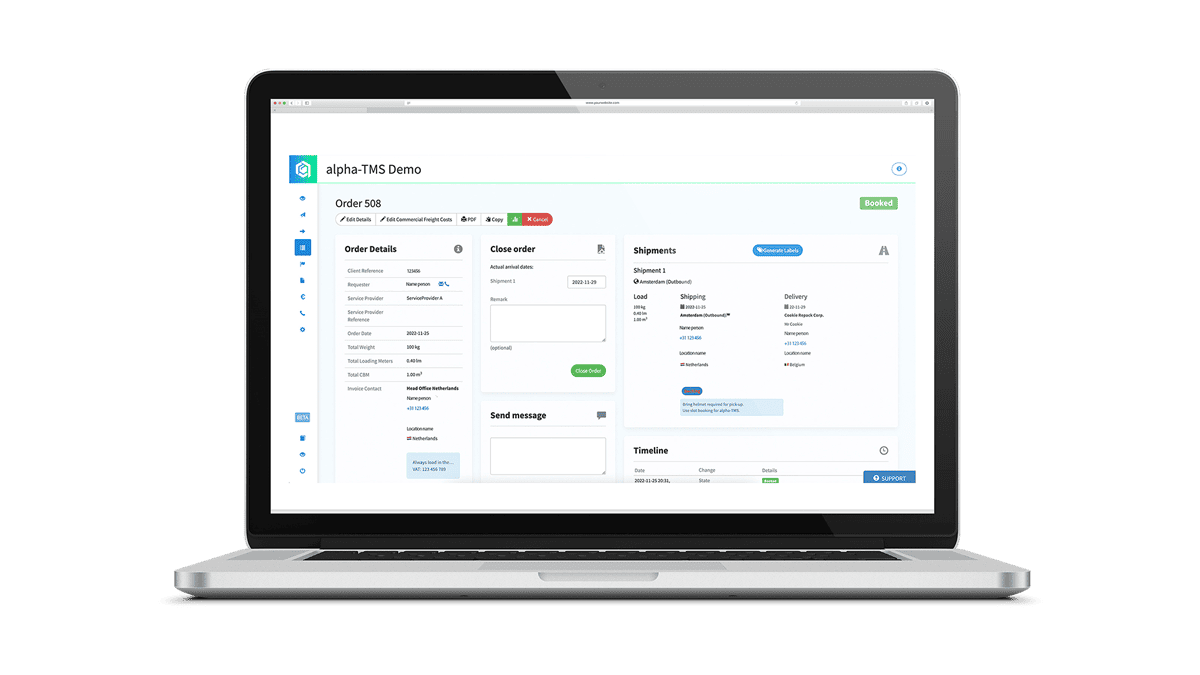

Time to streamline your procurement and transportation process

Discover how a smart TMS system from Transinnovate reduces errors, increases visibility and lowers costs.

Multimodal Transport

EXW

The Ex Works (EXW) Incoterm® entails the least obligations for the seller. They only need to make the goods available at an agreed place – often their premises, workshop, or storage space – for the buyer. EXW should never be used for cross-border transportation due to customs activities that cannot practically be done by the buyer.

CPT

The Carriage Paid To (CPT) Incoterm® means that the risk of loss or damage to the goods passes to the buyer once the seller hands over the goods to their carrier at their premises or another agreed loading point. The seller arranges and pays for transportation and related costs to the agreed destination. CPT is suitable for use with a letter of credit (LC) and container transport. In the latter case, it is advisable to make arrangements for Terminal Handling Costs (THC).

CIP

The Carriage and Insurance Paid To (CIP) Incoterm® is similar to CPT. The risk of loss or damage to the goods passes from the seller to the buyer once the seller hands over the goods to their carrier at their premises or another agreed loading point. The seller arranges and pays for transportation and related costs to the agreed destination. The difference with CPT is that the seller is obliged to take out goods transport insurance for the buyer in CIP. CPT is suitable for use with a letter of credit (LC) and container transport. In the latter case, it is advisable to make arrangements for Terminal Handling Costs (THC).

DAP

The Delivered At Place (DAP) Incoterm® entails many obligations for the seller. The seller arranges and pays for transportation to the agreed destination. They also bear the risk of loss or damage to the goods until they deliver the goods, not unloaded, to the buyer at this agreed place of destination (or place of delivery). As a carrier is only liable to a limited extent based on treaties, it may be wise for the seller to take out goods transport insurance.

DPU

The Incoterm® Delivered at Place Unloaded (DPU) imposes many obligations on the seller, just like DAP. The seller arranges and pays for transportation to the agreed destination. They also bear the risk of loss or damage to the goods until they deliver the goods, unloaded, to the buyer at the agreed destination (or place of delivery). DPU is essentially DAP, including unloading the goods. Since a carrier is limitedly liable under treaties, it may be wise for the seller to take out goods transport insurance.

DDP

The Incoterm® Delivered Duty Paid (DDP) imposes the most obligations on the seller. They arrange and pay for transportation to the agreed destination. They are responsible for customs clearance and pay any import duties in the destination country, such as customs duties and/or import VAT. They also bear the risk of loss or damage to the goods until they deliver the goods, not yet unloaded, to the buyer at the agreed destination (or place of delivery). Since a carrier is limitedly liable under treaties, it may be wise for the seller to take out goods transport insurance. For many countries, it is not advisable to use this option because the bureaucratic handling of import duties/VAT is often too complex for the selling party. This can be better handled in the destination country.

FCA

The Incoterm® Free Carrier (FCA) imposes slightly more obligations on the seller than the Incoterm® Ex Works (EXW). A seller only needs to transfer their goods to an agreed place – often their business premises or an external location such as a groupage warehouse or a terminal in the departure seaport – to the buyer (or their carrier). From that moment on, the buyer bears all transportation-related costs and the risk of loss or damage to the goods. For export shipments to a country outside the EU, the seller is responsible for the export declaration with customs. The buyer and seller are free to take out goods transport insurance for the part over which they bear transport risk. FCA should never be used in combination with a Letter of Credit (LC). If an LC requires a Bill of Lading (B/L or BOL) as a condition for payment, a situation can arise where the buyer can frustrate the transaction, for example, by canceling the transport order. The seller cannot claim their money without a BOL.

Transport by water specifically

We advise using these Incoterms® only when shipping bulk goods (loose loaded) via water, i.e., products without containers.

FOB

With the Incoterm® Free on Board (FOB), the seller bears the risk of loss or damage to the goods and all costs until they deliver the goods on board the ship named by the buyer at the agreed shipment port. From that moment on, the buyer bears the further costs and transport risk.

CFR

With the Incoterm® Cost and Freight (CFR), the seller bears the risk of loss or damage to the goods until they deliver the goods on board the ship at the agreed shipment port. The seller arranges and pays for transportation and related costs to the agreed destination port but does not bear the transport risk. CFR is suitable for use with an LC.

CIF

The Incoterm® Cost Insurance and Freight (CIF) is similar in content to CFR. The seller bears the risk of loss or damage to the goods until they deliver the goods on board the ship at the agreed shipment port. The seller arranges and pays for transportation and related costs to the agreed destination port and also bears the transport risk. CIF is suitable for use with an LC.

FAS

The Incoterm® Free Alongside Ship (FAS) means that the seller delivers the goods once they are placed alongside the designated shipping vessel, as specified by the buyer, at the agreed port of shipment. In practice, this means that the seller delivers the goods to the quay or a barge located alongside the departing ship. From that moment, the buyer bears the costs related to transport and the risk of loss or damage to the goods during transport. The buyer is also responsible for loading the departing ship from the quay or barge. Therefore, the exact loading location should be specified in the purchase agreement, as this is where the risk transfers to the buyer. The buyer and seller are free to take out a goods transport insurance policy for the part of the transport risk they run.

Applying Incoterms correctly is one thing, an efficient transportation system is the next step. Learn more about our TMS for modern logistics.

Relationship between purchasing transport and Incoterms.

What is the relationship between purchasing transport and Incoterms®? The Incoterms® determine the delivery condition between the shipper and its customer(s) and are often part of commercial negotiations. It is important for the person negotiating the commercial conditions to be well aware of the consequences of using certain Incoterms® and to use the appropriate term that corresponds to the modality to be used.

When a shipper purchases transport, it is important to know which Incoterms® apply to the delivery. This is so that the purchaser can align the purchased logistics services with what has been agreed between the sale and the customer. For example, which part of the transport do we need to organize (and therefore purchase), are there customs activities that our service provider may need to perform, how does transport insurance work, etc. The Incoterms® essentially determine what needs to be purchased.

Logistics service providers always want to know under which Incoterms® shipments are being shipped. This way, they know exactly who the paying party is, can prepare any documentation correctly, know who is responsible for customs activities, etc.

The Incoterms® do not include agreements between the shipper and the logistics service provider. In the case of the Netherlands, the AVC (General Transport Conditions) and, for international transport by road, the CMR (Convention on the Contract for the International Carriage of Goods by Road) apply.

If you would like to discuss what Incoterms® mean for optimal procurement and execution of transport, if you are using the right Incoterms in 2024 or if you have good or bad experiences that you would like to share with us, please feel free to contact us.

Ready to put Incoterms into action?

Discover how our TMS helps you apply them efficiently in real-world transport scenarios.