When Does Responsibility End in Maritime Trade?

In international shipping, the transition of responsibility between seller and buyer is not always obvious. While goods may physically move from one party to another, legal and financial liability often depends on carefully defined contractual terms. For companies engaged in global trade, understanding where that line is drawn is essential.

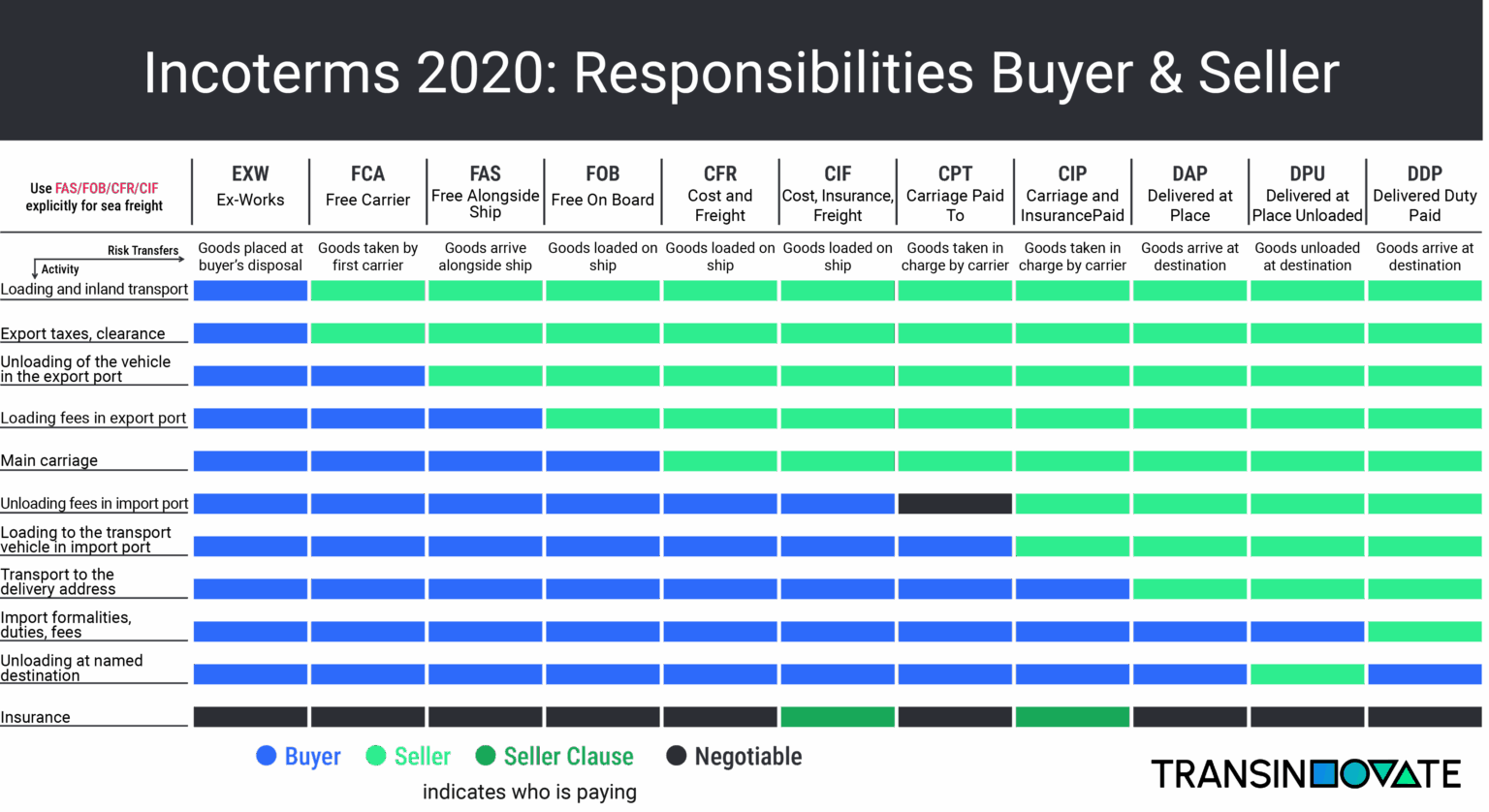

This is precisely where Incoterms® come into play. Published and maintained by the International Chamber of Commerce (ICC), these standardized terms define the roles, responsibilities, and risk distribution between buyers and sellers during international transactions. One of the most widely used Incoterms® for maritime transport is FOB – Free On Board.

What Is FOB Incoterm®?

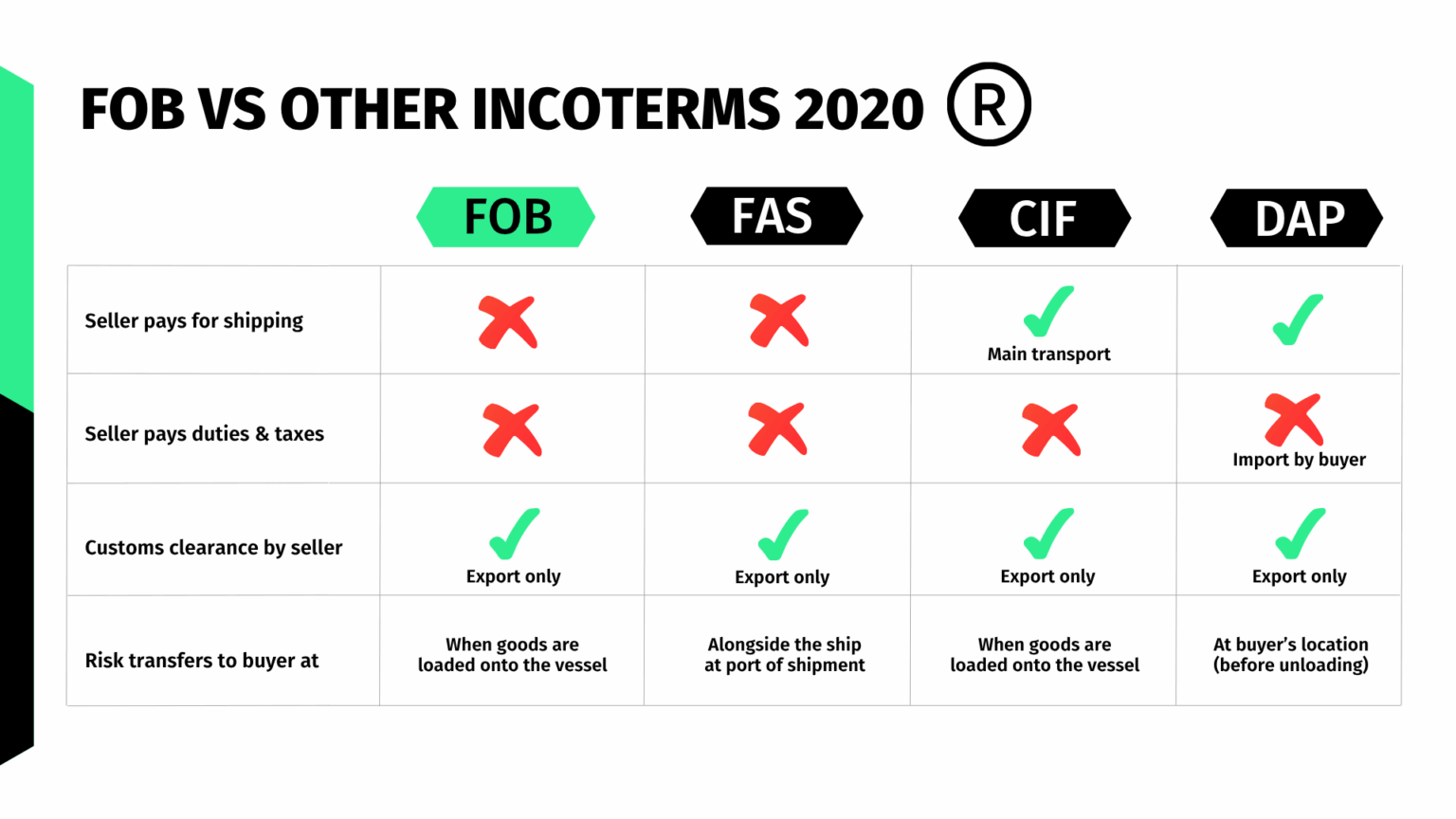

FOB (Free On Board) is an official Incoterm®2020 rule used exclusively for sea and inland waterway transport. Under FOB, the seller is responsible for delivering the goods on board a named vessel at the port of shipment. Once the goods are loaded, the risk and cost transfer to the buyer.

FOB clearly defines the point at which liability shifts, which is essential for minimizing disputes and ensuring contractual clarity.

An overview of all incoterms is available here.

Advantages of Using FOB

Clear risk demarcation

FOB defines an unambiguous point where risk transfers — the moment goods are on board. This reduces the likelihood of miscommunication or liability conflicts.

Buyer control over main carriage

Once the goods are loaded, the buyer selects the carrier, negotiates freight terms, and oversees the remainder of the transport chain — often optimizing cost and efficiency.

Seller focus on local logistics

The seller’s responsibility ends at the loading stage, allowing them to limit their involvement to local transport and export procedures.

Potential Drawbacks of FOB

Not ideal for containerized cargo

In container shipping, goods are typically handed over at a terminal, not directly loaded on a vessel. In such cases, FCA (Free Carrier) is more appropriate.

Risk borne by buyer during ocean freight

From the moment goods are loaded, the buyer assumes full risk. Delays, damage, or loss during transit fall entirely on the buyer unless separately insured.

Risk of loading disputes

Although loading is the seller’s responsibility, any damage or delays during this stage can lead to disagreements. Clear contract terms and loading procedures are essential.

Practical Example: FOB in Use

A European supplier sells mechanical parts to a distributor in Southeast Asia. The agreed delivery term is FOB – Port of Rotterdam. The supplier arranges inland transport, handles export clearance, and ensures the goods are loaded onto the buyer’s nominated vessel. Once loaded, the buyer takes over responsibility, organizing ocean freight, insurance, and delivery to the final destination.

Choosing the Right Incoterm® for Your Business

Whether you are exporting raw materials or importing finished goods, selecting the correct Incoterm® is critical for risk management and operational clarity.

Do you frequently engage in international shipments by sea?

Would you benefit from clearer division of transport responsibilities?

Contact our logistics team for expert advice on FOB, FCA, or other Incoterms®, and discover the most effective transport strategy for your specific trade scenario.

Not typically. Containerized shipments are better served under FCA, as containers are usually handed over at a terminal, not directly onboard a ship.

The buyer is responsible for ocean freight, marine insurance, and all import procedures from the port of shipment onward.

No. Insurance is the buyer’s responsibility once goods are loaded onto the vessel.

No. FOB applies only to maritime transport. For air or multimodal shipments, terms like FCA are more appropriate.