What is DDP Incoterm®?

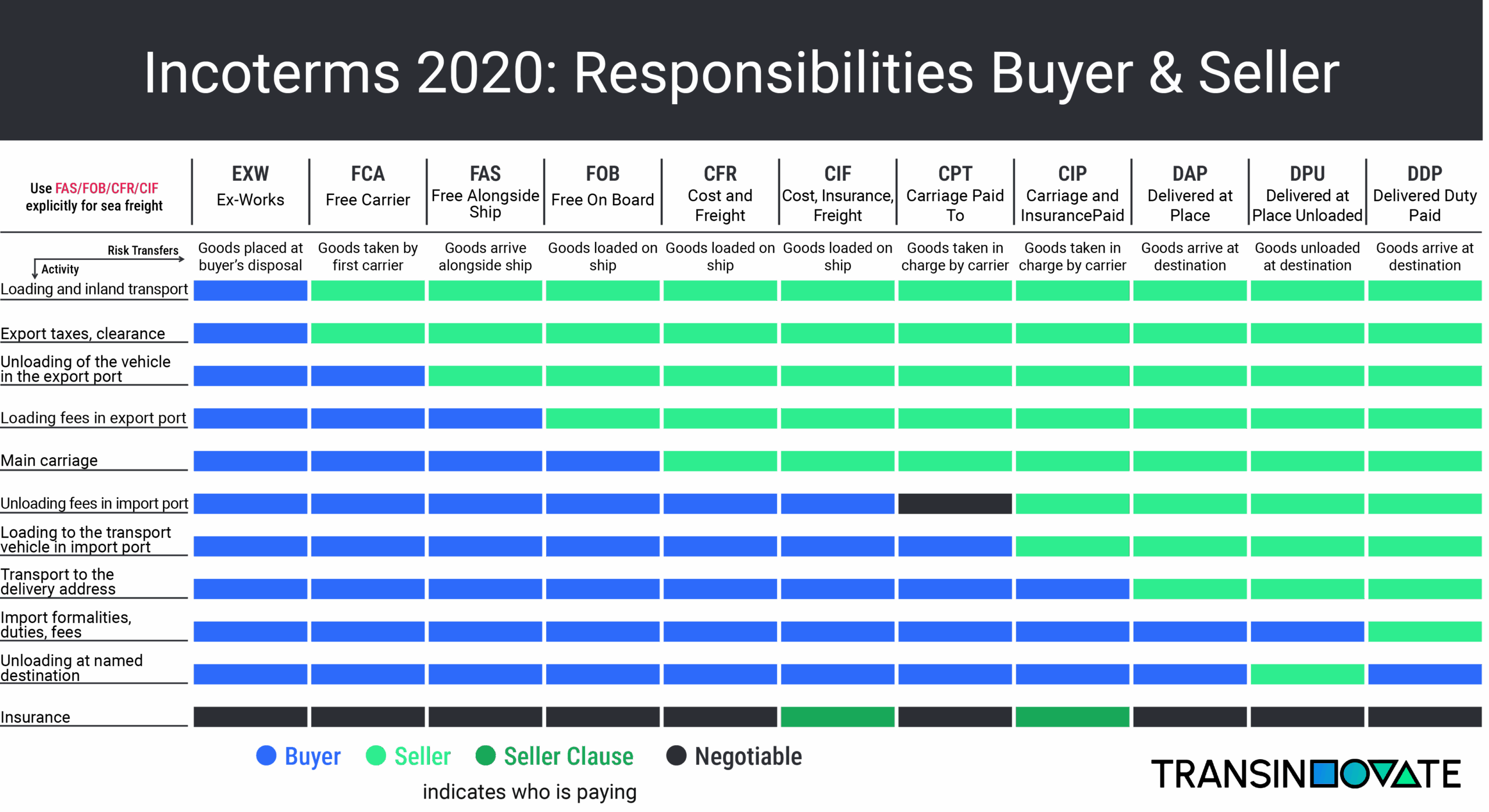

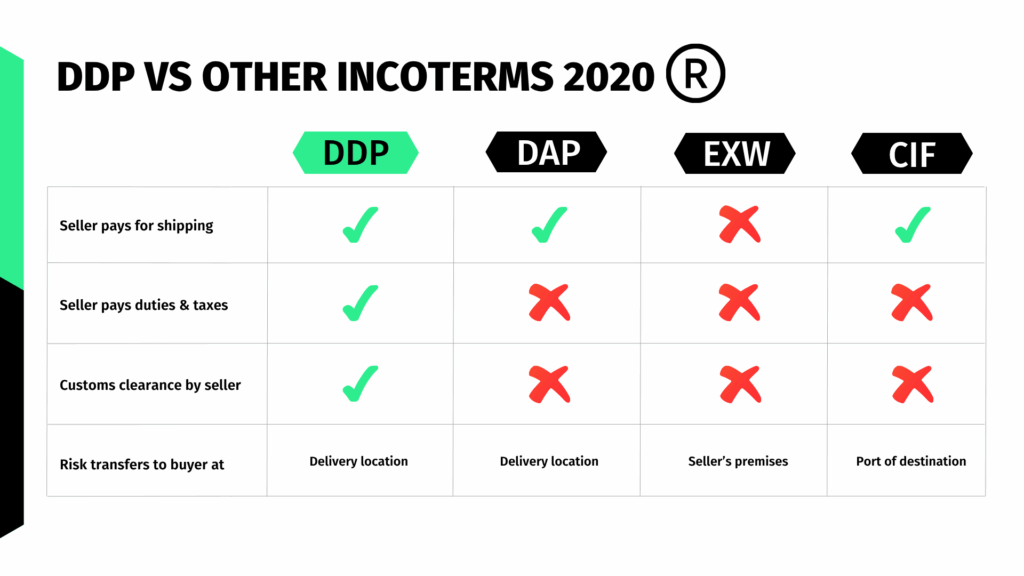

DDP (Delivered Duty Paid) is one of the official Incoterms® rules defined by the International Chamber of Commerce (ICC) that outlines responsibilities between sellers and buyers in international trade. Under the DDP Incoterm®, the seller bears full responsibility for delivering goods to the buyer’s final destination, including customs clearance, duties, and taxes.The latest version of the Incoterms®, ICC Incoterms® 2020, took effect on January 1st, 2020.

An overview of all incoterms is available here.

In a Delivered Duty Paid (DDP) Incoterm arrangement, the seller takes on the most extensive responsibilities by delivering the goods to the buyer’s location, covering all costs, including duties and taxes.

Advantages DDP Incoterm®

1. Reduced Risk for the Buyer

The seller handles the entire logistics process, including:

International shipping

Import clearance

Payment of customs duties and local taxes

Final delivery to the buyer’s location

This minimizes risk and administrative work for the buyer.

2. Single Point of Contact

Buyers deal with only one party—the seller—which simplifies the transaction, especially when they are unfamiliar with local customs laws or documentation.

3. Transparent Cost Structure

With DDP, the seller includes all costs in the final price. This allows the buyer to have a clear understanding of the total financial commitment without surprises.

Drawbacks DDP Incoterms®

1. Higher Overall Cost

The seller covers all expenses related to the delivery:

Customs duties

Import taxes

Local delivery fees

This results in a higher total price, which can reduce profit margins or make offers less competitive.

2. Regulatory and Logistical Complexity

The seller must navigate the buyer’s country regulations:

Import laws and restrictions

Customs clearance and documentation

Local compliance procedures

This requires experience or local partners to manage efficiently.

3. Limited Control for Buyers

The seller manages key logistics decisions, including:

Carrier and shipping method

Schedule and delivery preferences

Buyers may have limited influence or flexibility in these areas.

Example Of Using DDP in Global Trade

Let’s say a company in Germany sells electronic equipment to a client in Brazil. Using the DDP Incoterm®, the German seller arranges international freight, clears the goods through Brazilian customs, pays all import duties and taxes, and delivers the goods to the client’s door in São Paulo. The buyer receives the shipment fully cleared and doesn’t need to handle any logistics or paperwork.

Summary: Is DDP the Right Incoterm® for You?

Delivered Duty Paid (DDP) offers maximum convenience for the buyer by shifting all responsibilities—transport, customs clearance, duties, and delivery—to the seller. It’s ideal when:

The buyer wants a hassle-free delivery experience

The seller is experienced with international logistics and customs procedures

However, because of the added cost and complexity for the seller, both parties should evaluate their capabilities and expectations before agreeing to DDP terms. A clear contract and open communication are essential for a successful DDP arrangement.

Need Help Choosing the Right Incoterm®?

Whether you’re a buyer or a seller regularly involved in international shipping, selecting the right Incoterm® is crucial to manage cost, risk, and responsibilities.

👉 Contact us today to discuss which Incoterms® rule and transport solution best fit your business needs.

DDP (Delivered Duty Paid) means the seller is responsible for delivering goods to the buyer’s final destination, covering all transportation costs, customs clearance, import duties, and taxes. The buyer receives the goods without any involvement in the logistics or import process.

In a DDP agreement, the seller is fully responsible for paying all customs duties, import taxes, and clearance fees. The buyer is not required to handle any customs procedures or make any additional payments upon delivery.

Yes. DDP is one of the eleven official Incoterms® rules defined by the International Chamber of Commerce (ICC) in the 2020 edition. These rules came into effect on January 1st, 2020.

The key difference is in the responsibility for import duties and taxes. Under DDP, the seller pays for all import-related costs. Under DAP (Delivered at Place), the buyer is responsible for customs clearance and paying duties and taxes.

DDP is ideal when the buyer wants a hassle-free experience, and the seller has the knowledge or partners to handle customs procedures in the buyer’s country. It’s often used in e-commerce or high-service transactions where convenience is a priority.