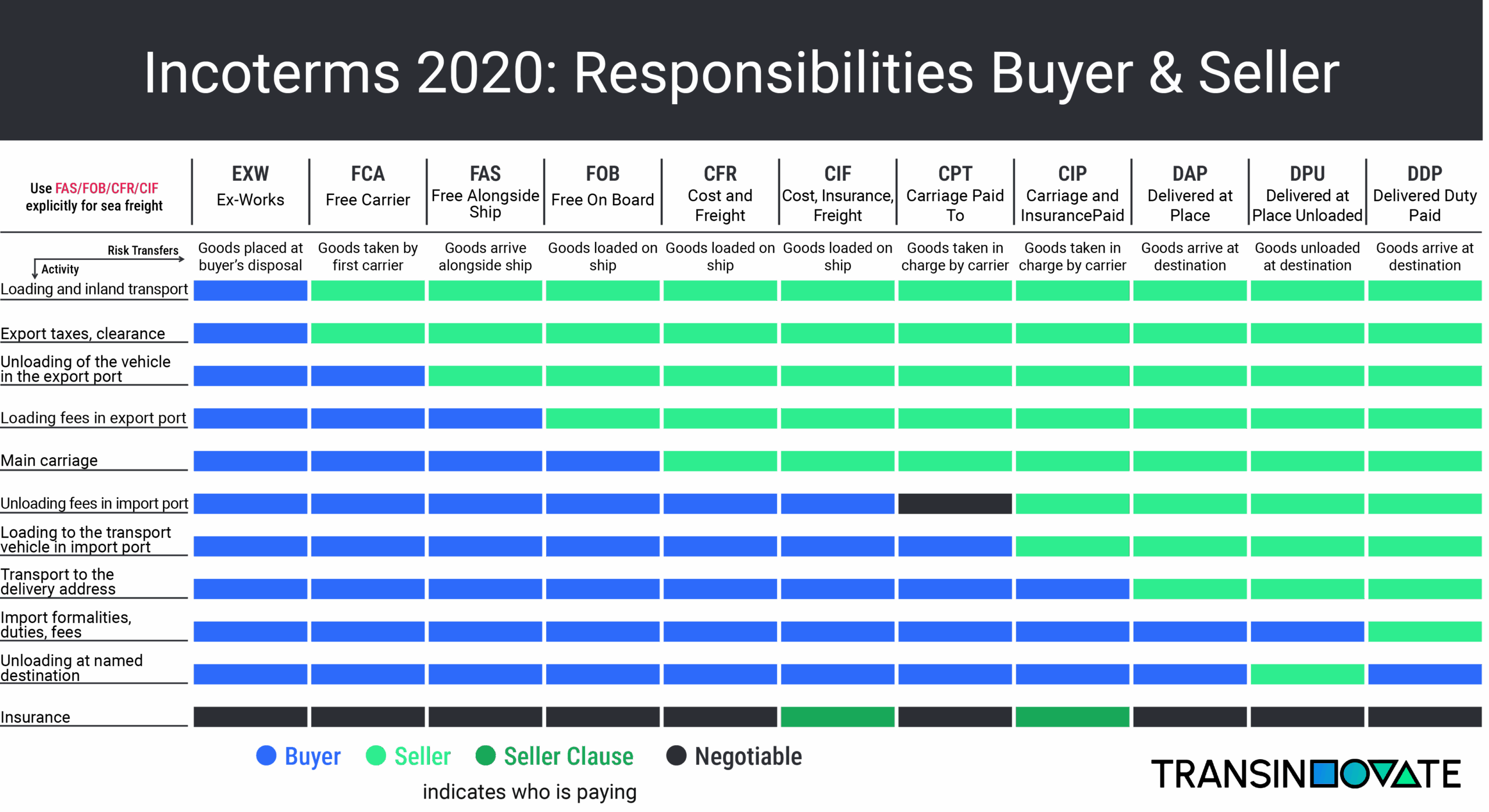

The CIF Incoterms® is one of the standardized international delivery terms agreed upon between buyer and seller. These are rules that establish worldwide agreements on transport, costs, and any potential damage during transportation. Every ten years, the International Chamber of Commerce (ICC) updates the Incoterms®. The most recent version, the ICC Incoterms® 2020, came into effect on January 1st, 2020. An overview of all incoterms is available here.

What is CIF Incoterm®?

The Cost, Insurance and Freight (CIF) Incoterm® is a widely recognized international trade agreement specifically designed for the transportation of goods over sea or inland waterways. Under a CIF arrangement, the seller assumes a significant portion of the responsibility and cost associated with delivering the goods. This includes not only transporting the goods to the agreed-upon port of destination but also paying for the freight charges as well as procuring and maintaining adequate insurance coverage to protect the shipment during transit. The seller is required to provide the buyer with the necessary documentation, such as the bill of lading and insurance policy, to enable the buyer to claim the goods upon arrival. It is important to note that, despite the seller’s extensive obligations regarding cost and insurance, the transfer of risk from the seller to the buyer occurs as soon as the goods pass the ship’s rail at the port of shipment. This distinction between cost responsibility and risk transfer is a defining characteristic of the CIF Incoterm and plays a crucial role in international maritime trade, as it clearly delineates the obligations, rights, and liabilities of both parties involved in the transaction.

Advantages CIF Incoterm®

-

- Comprehensive Service for Buyers: CIF Incoterm provides a comprehensive service for buyers as the seller is responsible for the cost of transportation to the named port, freight charges, and insurance. This minimizes the burden on the buyer and simplifies the purchasing process.

- Reduced Buyer Risk: With insurance included, CIF mitigates risks associated with transportation, such as damage, loss, or theft. Buyers benefit from added security, knowing that the goods are insured during transit.

- Clear Cost Structure: CIF offers transparency in costs as the seller covers transportation costs, freight charges, and insurance. Buyers have a clear understanding of the total financial commitment involved in the transaction.

Drawbacks CIF Incoterm®

- Limited Seller Responsibility: Sellers have limited responsibility after the goods are loaded onto the vessel. If issues such as damage or delays occur during the ocean freight, the buyer bears the responsibility and cost of addressing these problems.Risk Transfer at Ship’s Rail: The risk transfer point is when the goods pass the ship’s rail. If damage or loss occurs before this point, the seller is responsible. However, the risk transfers to the buyer relatively early in the transportation process.

- Risk Transfer at Ship’s Rail: The risk transfer point is when the goods pass the ship’s rail. If damage or loss occurs before this point, the seller is responsible. However, the risk transfers to the buyer relatively early in the transportation process.

- Potential for Disputes: Disputes may arise if there are disagreements about the loading process or if issues occur during the ocean freight. Clear communication and detailed agreements on loading procedures and responsibilities are crucial to mitigate these risks.

Summary Cost, Insurance and Freight

In summary, CIF Incoterm offers a comprehensive solution for buyers, with the seller covering transportation costs, freight charges, and insurance. While it provides a clear cost structure and risk mitigation, buyers need to be aware of the limited seller responsibility after the goods are loaded onto the vessel. Careful communication and a well-drafted contract are essential to ensure a smooth CIF transaction and avoid potential disputes. Do you frequently require goods to be transported in short sea of ocean freight, either as seller or as buyer?

If you would like to discuss which Incoterms® and transport solution fit best to your case, please contact us.

Also, you can check out our Linkedin profile for more interesting facts about Transinnovate!